The Sukanya Samriddhi Yojana and Senior Citizens Savings Scheme have emerged as the highest interest-generating schemes for savings accounts across the country, said a senior India Post official in Himachal Pradesh capital Shimla.

Even with the newly revised interest rates issued by the central government, these two schemes continue to provide attractive returns, which has led to a growing enthusiasm among investors.

Explaining the benefits, the senior India Post official said that the Sukanya Samriddhi Yojana offers an attractive interest rate of 8.20%. This scheme, specifically designed for securing the future of daughters, allows parents to open an account for their daughters between the ages of 0 to 10 years.

It also provides tax benefits, making it even more appealing to investors. Parents can open an account with an initial deposit as low as ₹1,000 and the account can be operated until the daughter turns 21.

However, parents can withdraw 50% of the total deposit once the daughter reaches 18 or gets married.

On the other hand, the Senior Citizens Savings Scheme, also offering an interest rate of 8.20%, provides a secure and high-return option for retirees.

This scheme is available for citizens aged 60 and above, and they can deposit up to ₹30 lakh. The maturity period for the scheme is five years, with an option to extend it for an additional three years.

These savings schemes continue to be a popular choice due to their high returns, safety and government backing, particularly for parents planning for their daughters’ future and for senior citizens looking for secure investment options post-retirement. More than FDs, people have been opting for these schemes.

With the increasing popularity of these schemes, many investors in Himachal Pradesh and beyond are now taking advantage of these high-interest rates to secure their financial futures.

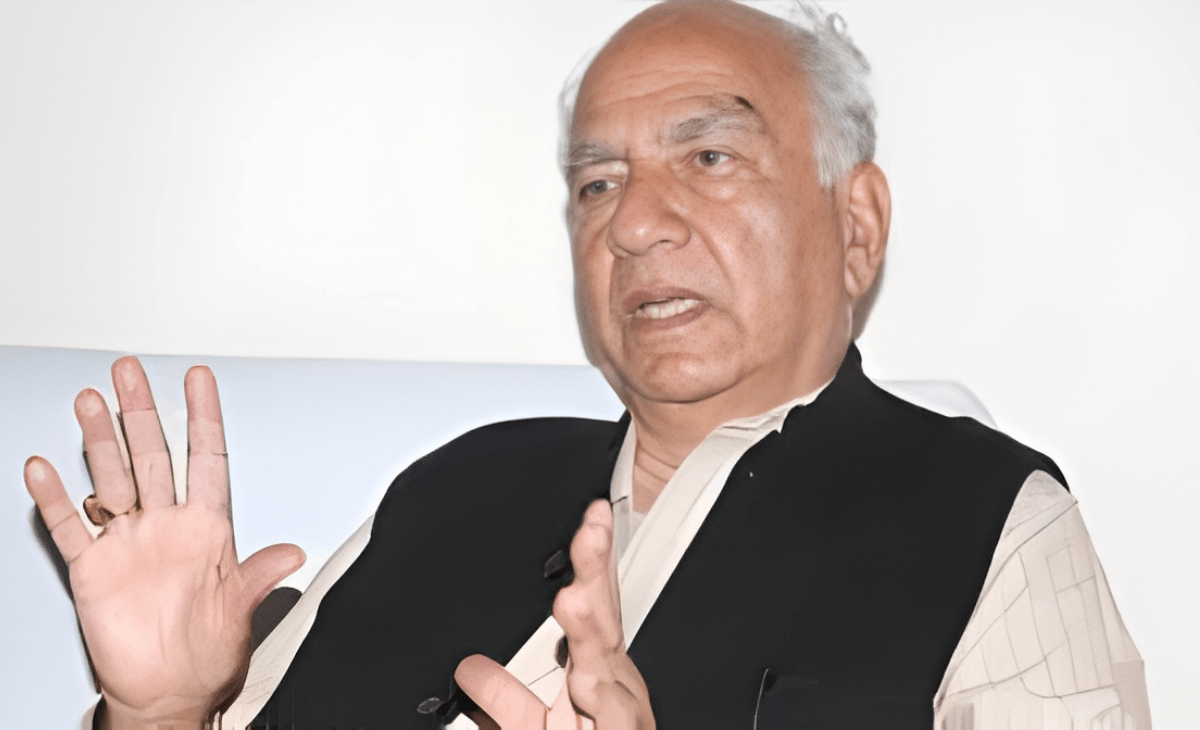

Sunil Chadha