MANDI: Chartered Accountants (CAs) are bracing for an increase in audit complexities and fees as the Institute of Chartered Accountants of India (ICAI) is set to introduce a new balance sheet format for non-corporate entities from April 1, 2025.

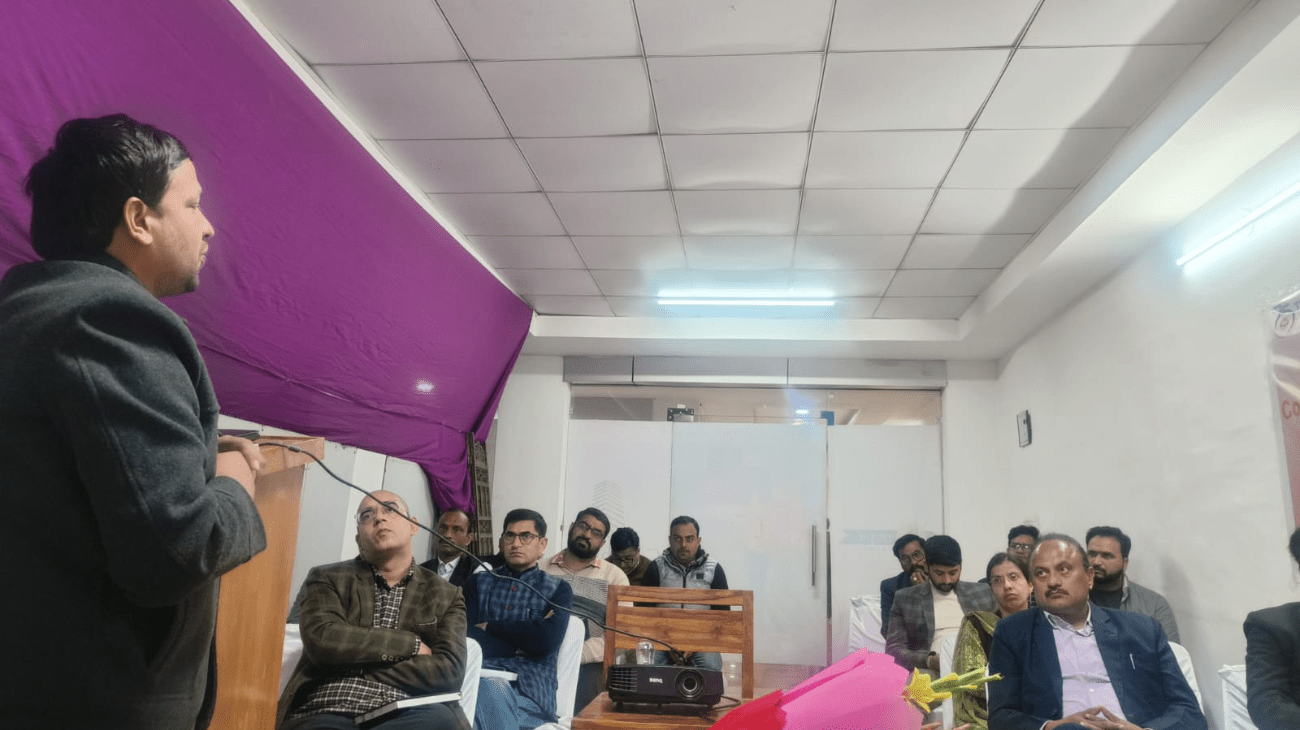

This development was the key focus of a seminar organised by the ICAI’s Himachal Pradesh branch at Bilaspur, which was aimed at briefing CAs on upcoming changes in financial reporting and recent GST amendments.

New format to align with Schedule-III, boost transparency

Addressing the gathering, CA Navneet Sharma provided a detailed analysis of the new balance sheet format, highlighting its alignment with the Schedule-III structure followed by corporate entities.

While the new format is designed to improve financial transparency, it also increases the workload for CAs, raising concerns over higher audit fees.

“The additional reporting obligations and enhanced compliance requirements will undoubtedly result in increased audit time and costs,” Sharma noted, urging CAs to prepare clients for the changes.

ICAI sets minimum tax audit fee at Rs 22,000

Speaking at the event, ICAI Himachal Pradesh Branch chairman Naresh Vashisht emphasised that the new format will impact businesses of all sizes. He pointed out that the complexity of audits will grow, leading to higher audit fees.

“With the revised structure demanding greater diligence and more time for financial statement preparation, a hike in audit charges is inevitable,” Vashisht said, adding that ICAI had already established a minimum tax audit fee of Rs 22,000 to reflect the increased workload.

GST amnesty scheme: Limited-time relief for taxpayers

The seminar also focused on recent GST amendments and the GST Amnesty Scheme, explained in detail by CA Hanish Sharma.

The scheme, aimed at reducing litigation and promoting tax compliance, offers waivers on interest and penalties for non-fraud tax demands from FY 2017-18 to 2019-20. However, taxpayers must settle their dues by March 31, 2025, to avail of the relief.

Sharma further highlighted a significant development regarding Input Tax Credit (ITC) on rental properties.

A Supreme Court ruling had initially allowed ITC claims on buildings used for rental purposes, but a subsequent retrospective amendment to the GST law — effective from 2017 — has nullified this benefit. CAs were advised to inform clients about this critical change to avoid future disputes.

Seminar equips CAs for evolving compliance landscape

Newly elected managing committee member CA Chetan Sankhyan thanked the attendees and speakers, noting the seminar’s relevance amid evolving financial regulations.

“This session provided vital updates that will help Chartered Accountants navigate upcoming challenges more effectively,” Sankhyan said.

The seminar concluded with a call for heightened preparedness among CAs as they face a more complex compliance environment, impacting both their professional responsibilities and client advisory roles.

Munish Sood(Mandi)