TNR Series: Part 10

Withdrawal limit for them still Rs 10,000, slow recovery causes anxiety

Sourabh Sood

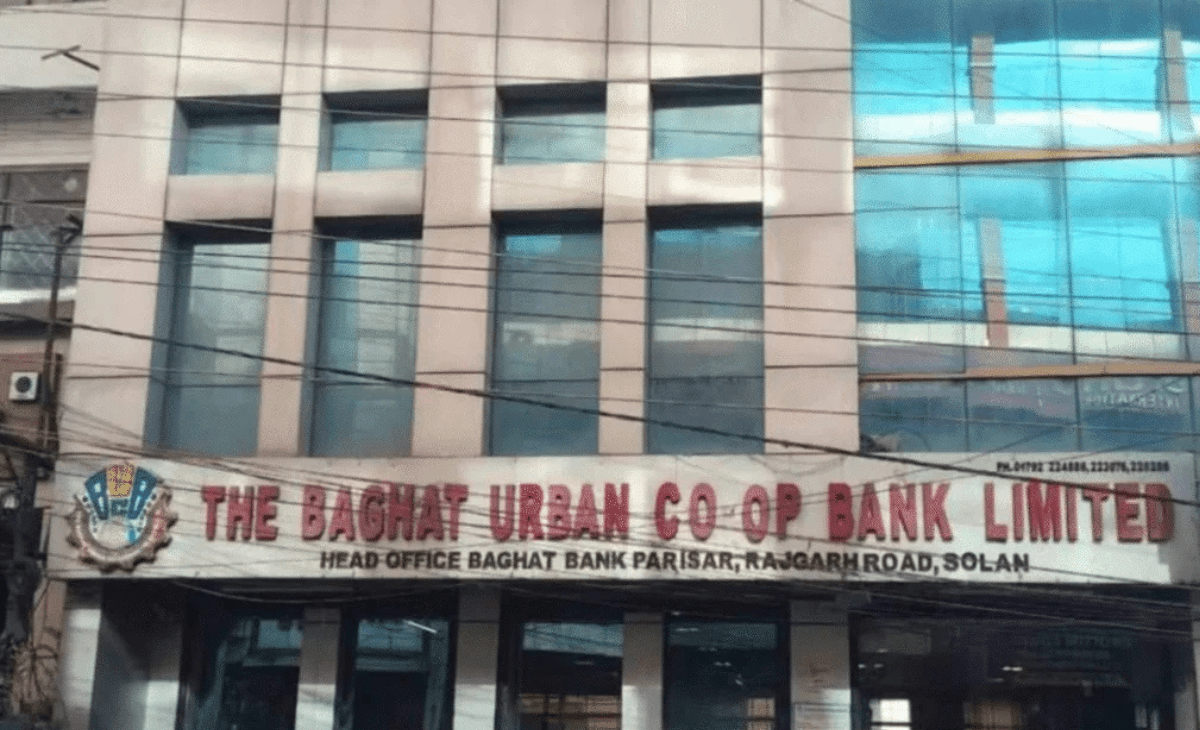

Shimla: The financial crisis at Baghat Urban Co-operative Bank continues to struggle with heavy non-performing assets (NPAs) and limited liquidity. Despite recovery drives and action against major defaulters, the Reserve Bank of India (RBI) has not lifted key restrictions, keeping thousands of depositors under financial stress.

The RBI’s directive restricting deposit withdrawals to Rs 10,000 per account continues. This cap imposed in October has not yet been relaxed for ordinary customers, though some conditional relief has been given to business accounts.

Bad loans remain high

Official reports show the bank’s NPAs still hovering around Rs 129 to 138 crore, reflecting its deep financial stress. The capital-to-risk ratio is in the negative, making a full revival difficult without major recovery.

Properties of 15 major defaulters have been attached under the SARFAESI Act. A large property auction drive has been initiated, though actual monetary recovery remains limited. A one-time settlement (OTS) scheme is underway and valid till December 31, 2025, to encourage repayment.

Reports indicate that some bank staff misused internal loopholes, worsening the financial losses. Several transactions and loan files are currently under scrutiny.

Minister’s fresh statement in Himachal Assembly

On the last day of the Himachal Pradesh Assembly session held at Dharamshala, the government made a brief statement on the issue. Deputy Chief Minister Mukesh Agnihotri, who also holds cooperative ministry, said that “Baghat Bank’s crisis was being monitored closely”. “The state government is in touch with the RBI and the Co-operative Department. Action against big defaulters will continue and depositors’ interests will be protected at all costs,” he said.

Agnihotri said that the state was reviewing whether administrative lapses contributed to the crisis and promised strict accountability.

With nearly 80,000 depositors affected, public pressure remains high. Many traders and retirees dependent on regular withdrawals continue to face hardship. While recovery efforts and government statements offer some reassurance, the future of the bank depends on meaningful loan recovery, liquidation of seized assets and regulatory approval from the RBI.