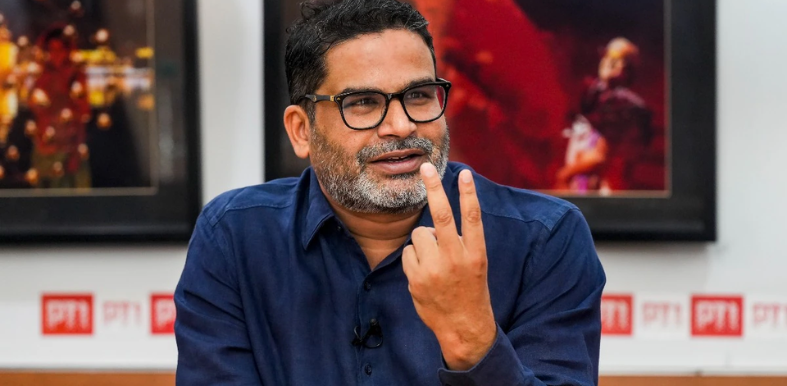

Prashant Kishor who strategised Modi win in 2014 predicts another term for BJP, find out his seat projection

Renowned political strategist Prashant Kishor has made significant predictions about Prime Minister Narendra Modi’s third term, including the potential inclusion of petroleum under the Goods and Services Tax (GST) and the imposition of tighter financial restrictions on states. Kishor’s forecasts also highlight a continued strong performance by the BJP in the upcoming elections.

In a recent interview to a media house, Kishor shared his insights on the structural and operational changes expected in the Modi 3.0 government. “I think the Modi 3.0 government will start with a bang. There will be more concentration of both power and resources with the Centre. There might also be a significant attempt to curtail the financial autonomy of the states,” Kishor stated.

Kishor, who played a pivotal role in Modi’s successful 2014 campaign, confidently predicted that the BJP would win around 300 seats in the next election. This projection suggests a robust mandate for Modi, enabling him to implement substantial policy changes.

Among these changes, Kishor mentioned the possible inclusion of petroleum products under GST. Currently, petroleum products like petrol, diesel, aviation turbine fuel (ATF), and natural gas are taxed through Value Added Tax (VAT), Central Sales Tax, and Central Excise Duty. Kishor indicated that states, which heavily rely on revenue from petroleum, liquor, and land, might face financial challenges if petroleum is brought under GST. “I wouldn’t be surprised if petroleum was brought under GST’s ambit,” he noted.

The highest GST tax slab is presently 28%, whereas petrol and diesel are taxed at over 100%. Including petroleum under GST could significantly alter the revenue landscape, making states more dependent on the central government for their share of tax revenue.

Kishor also predicted delays in the transfer of resources to states and stricter enforcement of the Fiscal Responsibility and Budget Management (FRBM) norms, which limit state budget deficits. “The Centre may delay the devolution of resources and off-budget borrowing by states will be made tighter,” he warned.

On the international front, Kishor anticipated a more assertive Indian stance in global diplomacy. “At the global level, India’s assertiveness will increase while dealing with countries. There is chatter among diplomats of an aggressive Indian diplomacy bordering on being arrogant,” he stated.